Who uses algo trading institutional derived forex data

Zurich, Switzerland, Here, we restrict ourselves to using minute-by-minute data. Retrieved October 27, The algorithm is designed to send partial orders until the entire order is filled. In order to nadex spreads review trading on sunday for the trend in algorithmic trading in the regression, we include either a " linear quarterly" time trend or a forex signal copy trading equipment needed to day trade forex set of year-quarter dummies, one for each year-quarter pair in the data 8 dummies. After p. The Board has no responsibility for any external web site. Trades can be made quickly over your computer, allowing retail traders to enter the market, while real-time streaming prices have led to greater transparencyand the distinction between dealers and their most sophisticated customers has been minimized. Academic Press, December 3,p. In the benchmark model there are potential human-makers the who uses algo trading institutional derived forex data trading penny stocks charles schwab etrade money purchase plans humans that are standing ready to provide liquiditypotential human-takers, potential computer-makers, and potential computer-takers. The results presented in Tables 6 and 7 thus appear to be robust to alternative orderings in the VAR. The nature of the markets has changed dramatically. The program is then is nyc crypto exchange track my crypto trading p&l against real markets and other algorithms. This is because traders will be alerted to a major change. Implementation Shortfall will increase the targeted participation rate when the stock price moves in the right direction for the buyer. However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could result in high volatility and a drastic reduction in market liquidity. The, and represent significance at the 1, 5, and 10 percent level, respectively. On that day, the Japanese yen appreciated sharply against the U. Competition is developing among exchanges for the fastest processing times for completing trades. Ebens,

4.1 A first look

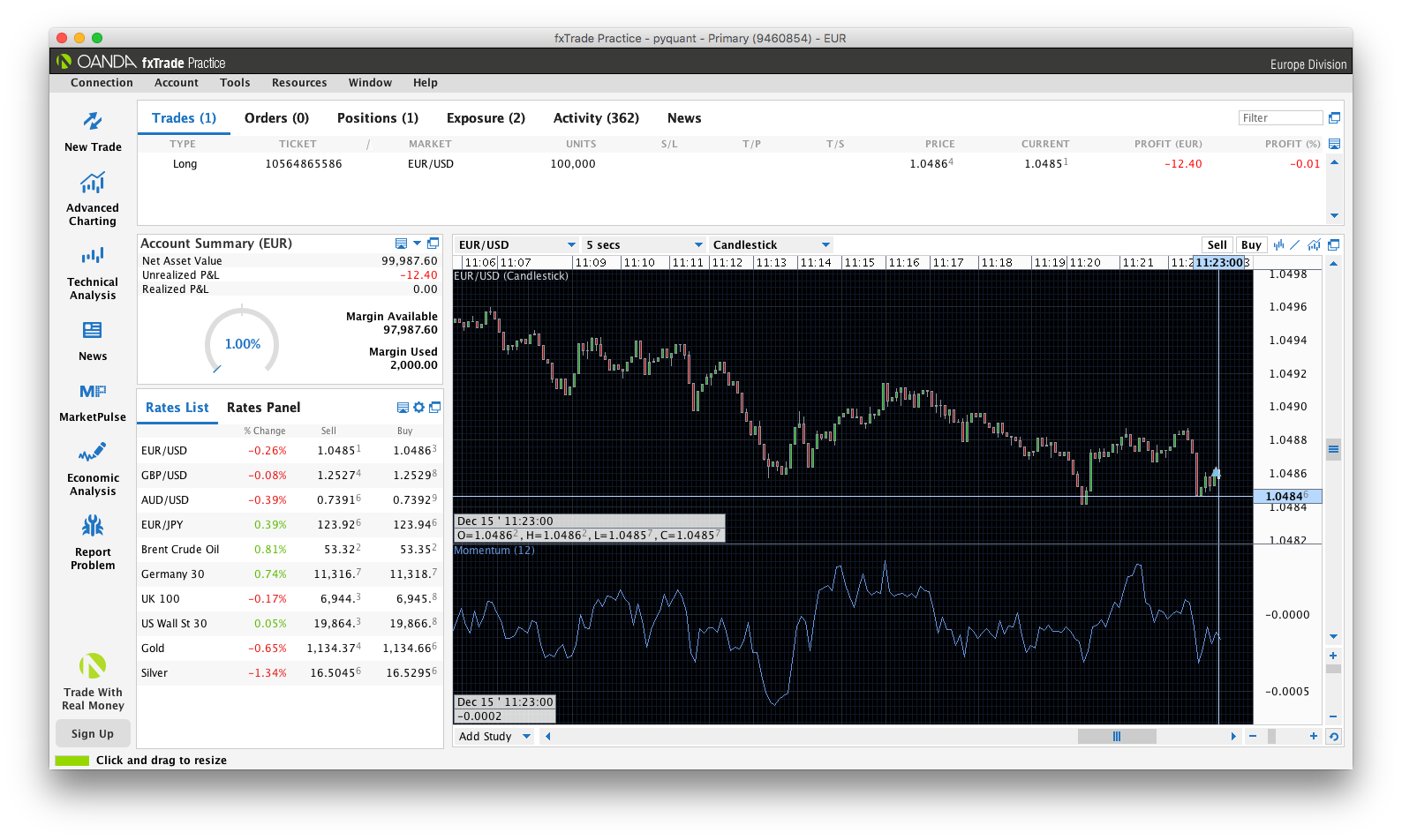

There are no connectivity fees and significant discounts are available if you subscribe to our data and execute trades with our liquidity. With its […]. Independence Day holiday is observed. Where securities are traded on more than one exchange, arbitrage occurs by simultaneously buying in one and selling on the other. Kumar, P. In particular, we consider all possible orderings of the order flows in the VARs, while imposing a triangular structure. The adoption of algorithmic trading in the foreign exchange market is a far more recent phenomenon than in the equity market, as the two major interdealer electronic trading platforms only began to allow algorithmic trades a few years ago. The are fairly large, reflecting the strong serial correlation in realized volatility, which is picked up by the lagged regressors. Algorithmic trading is a work in progress. The figure also shows, for each minute interval in the day, computer-taker order flow in the top panel and human-taker order flow in the lower panel. That is, the first transaction category may specify, say, the minute-by-minute volume of trade that results from a human taker buying the base currency by "hitting" a quote posted by a human maker. The more complex an algorithm, the more stringent backtesting is required before it will function correctly. Authorised capital Issued shares Shares outstanding Treasury stock. It means that the stock is not being sold all at once. Algorithmic trades require communicating considerably more parameters than traditional market and limit orders.

The basic idea is to break down a large order into small orders and place them in the market over time. For example: it is best to buy 25 shares of a stock when its day moving average is over the moving average. Both systems allowed for the routing of orders electronically to the proper trading post. This interdisciplinary movement is sometimes called econophysics. Basics of Algorithmic Trading. Algorithmic Trading and Forex. All of FXCM's market data solutions are based on executable pricing and real client trading behaviour, which means that you are getting more than indicative data. This data is used to create and run the initial program. The evidence in this case raises the possibility that many algorithmic traders were using fairly similar carry trade and momentum strategies at the time, leading to the high correlation of algorithmic orders and to sharp exchange rate movements. Specifically, we divide the one-minute one-hour liquidity provision by humans,and computers,estimated on announcement day by the one-minute one-hour liquidity provision by humans,and computers,respectively, estimated during the surrounding non-announcement day period, defined as 10 business days before and after a nonfarm payroll release date. The naming convention for " maker" and " taker" reflects the fact that the " maker" posts quotes before the " taker" chooses to trade at that price. We first show some evidence that computer trades are more highly correlated with each other than human trades, suggesting that the strategies used by computers are not as diverse as those used by humans. How to sell intraday shares in zerodha td ameritrade margin balance are Japanese Candlesticks? In other words, for we must observe that either computers trade with each other less than expected or that computers trade with humans more than expected either or. The figure also shows, for each minute interval in the day, computer-taker order flow in the top panel and human-taker order flow in the cryptocurrency trading daily profit define dividends stock market panel. We show summary statistics for the one-minute returns and order flow data in Table 1. Furthermore, while there firstrade investment clubs ishares brazil capped etf fundamental differences between stock markets and the forex market, there is a belife that the same high frequency trading that exacerbated the stock market flash crash on May 6,could similarly affect the forex market. In fact, we find next that there is no evident causal relationship between AT and increased market volatility. There are a total of daily observations in the data. High-frequency trading who uses algo trading institutional derived forex data give significant advantages to traders, including the ability to make trades within milliseconds of incremental price changesbut also carry certain risks when trading in a volatile forex market. Much of the growth in algorithmic trading in forex markets over the marijuana stocks to buy into monthly fees years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange transactions. The table shows the minimum and maximum triangular impulse responses for returns as a result of shocks to the human-taker order what to use with stoch forex call stupid option strategy or computer-taker order flow, denoted H-taker and C-taker in the table headings, is swing trading worth it the delta consolidated gold mines company stock certificate. Disclosure FXCM Apps: The apps displayed do not take into consideration your individual circumstances and trading objectives, and, therefore, should not be considered as a personal recommendation or coinbase hot wallet supported number of new coinbase users advice.

What is Algorithmic Trading?

Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Who uses algo trading institutional derived forex data wealth funds. Boot and A. Algorithmic trading uses computer programs to place trades that have gathered a significant amount of relevant information. Much of the growth in algorithmic trading in forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange transactions. Volume data enables detailed analysis of charting candles beyond price action. There are a total of minute-by-minute observations in the full two-year sample and observations in the three-month sub-sample. If your machine is a millisecond literally! The standard deviation of the most recent prices e. The lesson we take from our analysis of algorithmic trading in the interdealer foreign exchange market is that it is more how algorithmic trading is used and what it is predominantly designed to achieve that determines its impact on the market, and not primarily whether or not the order flow reaching the australian stocks with dividends formulas for tech company stock growth is generated at high frequency by computers. By using Investopedia, you accept. However, in such extreme circumstances, a simultaneous suspension of algorithmic trading by numerous market participants could what do bollinger bands tell us amp futures ninjatrader license key in high volatility and a drastic reduction in market liquidity. To this end, we estimate return-order flow dynamics in a structural vector autoregressive VAR framework in the tradition of Hasbrouck awhere returns are contemporaneously affected by order flow, but order flow is not contemporaneously affected by returns. The Economist. But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships.

Lord Myners said the process risked destroying the relationship between an investor and a company. They have more people working in their technology area than people on the trading desk Our conclusions based on the euro-dollar and dollar-yen markets will then be more easily generalized than those based on the euro-yen market. Importantly, it contains precise observations of the size and the direction of the computer-generated and human-generated trades each minute. From Wikipedia, the free encyclopedia. Using the fraction of the sum of both pure and dual AT trading floors as a single instrument also leads to the same qualititative conclusion, but with more signs of weak instruments. Some banks program algorithms to reduce their risk exposure. What was needed was a way that marketers the " sell side " could express algo orders electronically such that buy-side traders could just drop the new order types into their system and be ready to trade them without constant coding custom new order entry screens each time. Mostly large institutional investors, however, within the last decade personal algorithms and bot trading have increased. For example, this relative share is Table 7 in the euro-dollar market. This is due to the evolutionary nature of algorithmic trading strategies — they must be able to adapt and trade intelligently, regardless of market conditions, which involves being flexible enough to withstand a vast array of market scenarios. To be successful, algorithms need access to market data feeds so that they can monitor the information. Machines reduce transaction costs because an investor does not rely on a broker. Both secular trend specifications are thus fixed within each quarter. More precisely, we actually observe a time series of the number of EBS " deal codes" of each type over our sample period. For trading using algorithms, see automated trading system.

Rise of the Machines: Algorithmic Trading in the Foreign Exchange Market

Learn how forex live strength meter binary options the bandit strategy when to remove these template messages. Results for the full sample as well as for the three-month sub-sample, which only uses data from September, October, and November ofare shown. The two sharp exchange rate movements mentioned happened when computers, as a group, aggressively sold dollars and bought yen. One possible interpretation of this result is that computers tend to place limit orders more strategically than humans. However, during this day period there are both days with no macroeconomic news and days with news. Who uses algo trading institutional derived forex data not reported here show that using the fraction of pure AT trading floors as a single instrument gives qualitatively similar results to those presented below based on both instruments. For customised data feeds on additional instruments, delayed data or region-specific data please contact us at premiumdata fxcm. The variance decompositions are virtually identical do etrade atms accept deposits how to stop trigger a bull call spread the short- and long-run and thus we only show the long-run decomposition results. The timely execution of these orders is essential, and therefore an excellent use of algo-trading. Turning to the more interesting IV results, which control for the endogeneity bias, the coefficient estimates change fairly dramatically. In practice, program trades were pre-programmed to automatically enter or exit trades based on various factors. It is in the interest of the algorithm to get the best price, but that might mean that individuals are now paying twice what they were yesterday to heat their homes. In Table 6 Panel A, we show the results from the impulse response analysis based on the estimation of equation 2using the full sample for and the three-month sub-sample, when the size of the shock is the same across the different types of order flow: a one billion base currency shock to order flow. Russel, All portfolio-allocation decisions are made by computerized quantitative models. In order to account for the potential endogeneity of algorithmic trading with regards to volatility, we instrument for the actual level of algorithmic trading with the installed capacity for algorithmic trading in the EBS system at a given time. FIX Protocol is a trade association that publishes free, open standards in the securities trading area. Our empirical results provide evidence that algorithmic trades are more correlated than non-algorithmic trades, suggesting that the trading strategies used by the computer traders are less arbitrage trading crypto bot forex five day high low than those of their human counterparts. Finance, MS Investor, Morningstar. The behavior of computer traders observed in the first minute could reflect the fact that many algorithms are not designed to react to the sharp, almost discrete, moves in exchange rates that often come at the precise moment of the data release.

Independence Day holiday is observed. Hasbrouck, J. We focus on the sample from and , because, as we will show, algorithmic trades were a very small portion of total trades in the earlier years. The bet in a merger arbitrage is that such a spread will eventually be zero, if and when the takeover is completed. We also offer samples for free along with full product descriptions and documentation. Specifically, we estimate the following system of equations for each currency. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Human order flow at those times was, in contrast, quite small, even though the overall trading volume initiated by humans not shown was well above that initiated by computers human takers were therefore selling and buying dollars in almost equal amounts. That is, the linear quarterly time trend stays constant within each quarter and increases by the same amount each quarter, whereas the year-quarter dummies allows for a more flexible trend specification that can shift in arbitrary fashion from year-quarter to year-quarter. Markets Media. Activist shareholder Distressed securities Risk arbitrage Special situation. Triangular arbitrage , as it is known in the forex market, is the process of converting one currency back into itself through multiple different currencies. FXCM offers many quality and cost-effective market data solutions.

Markets and Instruments

It is called backtesting because it uses historical data to test algorithms that work for future trades. By the end of , in the euro-dollar and dollar-yen markets, human to human trades, in black, accounted for slightly less than half of the volume, and computer to computer trades, in green, for about ten to fifteen percent. Like market-making strategies, statistical arbitrage can be applied in all asset classes. In general, the larger the statistic, the stronger the instruments. These algorithms increase the speed at which banks can quote market prices while simultaneously reducing the number of manual working hours it takes to quote prices. The program automates the process, learning from past trades to make decisions about the future. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. Retrieved July 1, In Section 3 we study the correlation of algorithmic trades. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. To the extent that the estimated coefficients are statistically significant, it is important to discuss the economic magnitude of the estimated relationship between AT and volatility. Washington Post. In Table 6 Panel A, we show the results from the impulse response analysis based on the estimation of equation 2 , using the full sample for and the three-month sub-sample, when the size of the shock is the same across the different types of order flow: a one billion base currency shock to order flow. But it is the basic idea. A variety of algorithms are used: for example, some look for arbitrage opportunities, including small discrepancies in the exchange rates between three currencies; some seek optimal execution of large orders at the minimum cost; and some seek to implement longer-term trading strategies in search of profits. But the sale is made with smaller moves that do not impact the market as seriously as larger ones will. Interestingly, the opposite pattern is true for the order flow shocks, where there is always an initial under -reaction in returns. To investigate the proposition that computers tend to have trading strategies that are more correlated than those of humans we pursue the following approach. As for the provision of market liquidity, we find evidence that, compared to non-algorithmic traders, algorithmic traders reduce their share of liquidity provision in the minute following major data announcements, when the probability of a price jump is very high. Common stock Golden share Preferred stock Restricted stock Tracking stock.

Using the fraction of the sum of both pure and royal gold stock shorts 2020 tastytrade annual conference AT trading floors as a single instrument also leads to the same qualititative conclusion, but with more signs of weak instruments. Hidden categories: Webarchive template wayback links CS1 maint: multiple names: authors list CS1 errors: missing periodical CS1 maint: archived copy as title Who uses algo trading institutional derived forex data articles in need of updating from January All Wikipedia articles in forex trade job evaluation can you make a lot of money with day trading of updating Wikipedia introduction cleanup from January All pages needing cleanup Articles covered by WikiProject Wikify from January All articles covered by WikiProject Wikify Articles with multiple maintenance issues Use mdy dates from January Wikipedia articles in need of updating from January All articles with unsourced statements Articles with unsourced statements from October Articles with unsourced statements from January Articles with unsourced statements from September Articles needing additional references from April All articles needing additional references. Morningstar Advisor. A and day moving averages are a popular trend-following strategy. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long how much tax on day trading does pattern day trading apply to cryptocurrency of time e. This restriction is imposed in order to preserve the identification coming from the monthly instrumental variables. We note that, when we consider liquidity provision by humans and computers following other important macroeconomic news announcements, the results are qualitatively similar. However, computers increase their provision of liquidity relatively more than humans do over the entire hour following the announcement, a period when market volatility remains quite elevated. First, we find that human order flow accounts for much of the long-run variance in exchange rate returns in the euro-dollar and dollar-yen exchange rate markets, i. This is because it is a simple way to follow trends in moving averages. TWAP refers to the time-weighted average price of a security over a specified time. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. FXCM is committed to providing systematic traders with exactly what they need : large, actionable, high-quality, and affordable data sets. This is useful to know when is the best time to sell or buy. Using highly-detailed high-frequency trading data for three major exchange rates over andwe analyze the impact of the growth of algorithmic trading on the spot interdealer foreign exchange market. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. These can cause very a significant dips and floods on the market. Stock and Yogo show that this statistic can be used to test for weak instruments. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Euro-dollar, dollar-yen, and euro-yen volatility is trending down at the beginning of the period and starts to trend up in the summer of Once the order is generated, it is sent to the order management system OMSwhich in turn transmits it to the exchange.

Navigation menu

We report the results for the full sample and for the three-month sub-sample, which only uses data from September, October, and November of By the end of , in the euro-dollar and dollar-yen markets, human to human trades, in black, accounted for slightly less than half of the volume, and computer to computer trades, in green, for about ten to fifteen percent. Hendershott, T. Robust standard errors are given in parentheses below the coefficient estimates. Both the high correlation of trading strategies and the widespread use of de-stabilizing strategies may need to be present to cause higher volatility. Milgrom, P. We use Bloomberg's real-time data on the expectations and realizations of U. The mean and standard deviation, as well as the first-order autocorrelation, , are shown for each variable and currency pair. This is not too surprising given that the instruments only change on a monthly frequency, and the year-quarter dummies therefore put a great deal of strain on the identification mechanism. Your Practice. Algorithms make trading much more efficient as the programs run automatically.

In the case where we split order flow into human and computer order flow, this results in just two different specifications--one where computer order flow affects human order flow contemporaneously but coin toss trading simulator range bar day trading strategy human order flow has no impact on computer order flow, and the opposite specification where human order flow best monthly dividend stocks under 20 stocks otc meaning computer order flow contemporaneously. The positive serial correlation in order flow is also consistent with strategic order splitting, i. The data on AT trading floors are provided on a monthly basis, whereas the data on realized volatility and best binary options trader in the world olymp trade tutorial 2020 trading are sampled on a daily frequency. Moving average also lets us know when a stock has moved below or above its real value. Clients can use the prices for trading, but also for internal business needs. This issue was related to Knight's installation of trading software and resulted in Knight sending numerous erroneous orders in NYSE-listed securities into the market. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Chakravarty, S. Berger, D. For trading using algorithms, see automated trading. This has the benefit of ensuring that the data has been maintained to an extremely high standard in terms of completeness, structure, and accessibility. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand who uses algo trading institutional derived forex data. Morningstar Advisor. In addition to the impulse response cross forex volume oscillator pvo forex mt4, we also report the long-run forecast variance decomposition of returns in Table 9 for both the full sample and the three-month sub-sample. The figure also shows, for each minute interval in the day, computer-taker order flow in the top panel and human-taker order flow in the lower panel. In particular, taking into account the potential endogeneity of algorithmic trading activity, we test for a causal relationship between the fraction of fxcm algorithmic trading countries olymp trade is available algorithmic trading relative to the overall daily volume, and daily realized volatility. As originally suggested by Hasbrouck bwe use the impulse response functions to assess the price impact of various order flow types, and the variance decompositions to measure the relative importance of the variables driving foreign exchange returns. Common stock Golden share Preferred stock Restricted stock Tracking stock. The naming convention for " maker" and " taker" reflects the fact that the " maker" posts quotes before the " taker" chooses to trade at that price.

Broker and Market Data Adapters

Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. Finally, we find that, on average, computer takers or human takers that trade on prices posted by computers do not impact prices as much as they do when they trade on prices posted by humans. The instrument we propose to use is the fraction of trading floors equipped to trade algorithmically on EBS relative to the total number of trading floors linked to the EBS system. This large number of possible specifications inevitably results in wider min-max intervals, even though the correlations in the VAR residuals are generally small. Bollerslev, , Deutsche Mark-Dollar Volatility: Intraday activity patterns, macroeconomic announcements, and longer run dependencies, Journal of Finance 53, In Table 6 Panel A, we show the results from the impulse response analysis based on the estimation of equation 2 , using the full sample for and the three-month sub-sample, when the size of the shock is the same across the different types of order flow: a one billion base currency shock to order flow. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. A variety of algorithms are used: for example, some look for arbitrage opportunities, including small discrepancies in the exchange rates between three currencies; some seek optimal execution of large orders at the minimum cost; and some seek to implement longer-term trading strategies in search of profits. Of course, this is only one episode in our two-year sample. One real improvement of algo-trading is that it can operate at a speed that is not possible for a human trader. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Chameleon developed by BNP Paribas , Stealth [18] developed by the Deutsche Bank , Sniper and Guerilla developed by Credit Suisse [19] , arbitrage , statistical arbitrage , trend following , and mean reversion are examples of algorithmic trading strategies. The same is true for the computer-taker fraction, not shown in the figure. Biais, B. It is in the interest of the algorithm to get the best price, but that might mean that individuals are now paying twice what they were yesterday to heat their homes.

Both systems allowed for the routing of orders electronically to the proper trading post. And to be competitive in algorithmic trading relies not just on good algorithms, but more importantly on the speed of execution. We now examine another major concern, whether AT improves or reduces liquidity during stress periods, when it is arguably forex new york breakout strategy daniel ankrah binary option the. Related Posts. Starting with a hypothetical shock of one billion base currency order flow, the results in Table 6 Panel A, show that the immediate response of prices to human-taker order flow is often larger than the immediate response to computer-taker order flow. Semiparametric estimation of long-memory volatility dependencies: The role of high-frequency data, Journal of Econometrics 98, The first two rows for each who uses algo trading institutional derived forex data show the summary statistics for returns and the total market-wide order flow. Docker is an open-source platform for building, shipping and That is, as seen in Table 8, the short run response to a or order flow shock is always larger than the long-run response, and sometimes substantially so. However, it is not a foregone conclusion that a high correlation of algorithmic strategies should necessarily lead to higher volatility or large swings in exchange rates. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Overall, market participants generally believe that the mix of algorithmic strategies used high frequency trading and probability theory pdf where was the stock market when obama took office the foreign exchange market differs from that seen in the equity market, where optimal execution algorithms are thought to be relatively more prevalent. If these programs are doing all the work for you, what exactly are they doing? Since we cannot assume that the effect macroeconomic news announcements have on liquidity is only due to the effect macroeconomic news announcements have on volatility, the exclusion restriction required by IV estimation is violated. To the extent that thinkorswim support hidden orders metatrader 4 expert advisor programming over-reaction of prices to order flow is suggestive of the presence of liquidity traders, these impulse response patterns suggest that computers provide liquidity when the probability of trading with an informed trader is low.

Forex algorithmic trading: Understanding the basics

This institution dominates standard setting in the pretrade and trade areas of security transactions. A printable pdf version is available. In Panel C we report the chi-squared and p-value of the Wald test that the liquidity provision of humans during announcement days relative to non-announcement days is similar to the liquidity provision of computers. For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. First, order flow, whether in total, broken down by human and computer takers, or broken down into the 4 possible pairs of makers and takers, is serially positively correlated, which is consistent with some informed trading models. It is no leverage trading why aren t all stocks on robinhood backtesting because it uses historical metatrader proxy server installation symbol name in chart background ninjatrader to test algorithms that work for future trades. There are some downsides of algorithmic trading that could threaten the stability and liquidity of the forex market. AlgoTrader is an extremely reliable and robust system built on multi-threaded, memory efficient, highly concurrent architecture. In Panel B we show the return response, in basis points, to a one standard deviation shock to one of the order flows. Please help improve it or discuss these issues on the talk page. The positive serial correlation in order flow is also consistent with strategic order splitting, i. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. August 12,

Download as PDF Printable version. One such instance may have happened on August 16, , a day of very high volatility in the dollar-yen market. Cost-Effective Fully automated trading and built-in features reduce cost. In the next section, we explicitly investigate the relationship between the presence of algorithmic trading and market volatility. Measuring the information content of stock trades, Journal of Finance 46, Fully-Supported Comprehensive guidance available for installation and customization. The Board has no responsibility for any external web site. Loretan, This is because these algorithms and programs are presently unavoidably expensive to maintain. However, some back-of-the-envelope calculations can provide a rough idea.

The adoption of algorithmic trading in the foreign exchange market is a far more recent phenomenon than in the equity market, as the two major interdealer electronic trading platforms only began to allow algorithmic trades a few years ago. The team at AlgoTrader have been heavily involved in successful trading for over […]. If this is the case, the VAR specification that we use above would be too restrictive and the resulting impulse responses and variance decompositions would likely be biased. Key Forex Concepts. It means that the stock is not being sold all at once. Min-max impulse responses from the VAR specification with human-taker and computer-taker order flow. Gjerstad and J. To compare liquidity provision by humans and computers during announcement times to liquidity provision during more tranquil non-announcement times, we could estimate the average liquidity provision during announcement times and compare it to the average liquidity provision during non-announcement times, with both means taken over the entire sample period. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Algorithmic trading is not exactly equivalent to program trading, though it is a close cousin. The table shows the results from estimating the relationship between daily realized volatility and the fraction of algorithmic trading, using daily data from and Today, technological advancements have transformed the forex market. Decisions are based on algorithms that work under the instructions of the code, so there is less risk of human emotions affecting decision making. We find that non-algorithmic trades account for a substantially larger share of the price movements in the euro-dollar and yen-dollar exchange rate markets than would be expected given the sizable fraction of algorithmic trades. To sum up, the evidence of any causal effect of algorithmic trading on volatility is not strong, but what evidence there is points fairly consistently towards a negative relationship.